Contents

What are the books of Accounts?

Books of Accounts- It means determining what transactions to record, i.e., to identify events that are to be recorded. It involves observing activities and selecting those events that are of a considered financial character and relate to the organization. The business transactions and other economic events, therefore, are evaluated to decide whether it’s to be recorded in books of account.

For example, the worth of human resources, changes in managerial policies, or appointment of personnel are important but none of those is recorded in books of account. However, when a corporation makes a purchase or purchase, whether on cash or credit or pays salary it’s recorded within the books of account.

Every transaction involves a give-and-take aspect. In double-entry accounting, every transaction affects and is recorded in a minimum of two accounts. When recording each transaction, the entire amount debited must equal the entire amount credited.

Rules of Debit & Credit in the Books of Accounts

The books of accounts Debit-Credit & books of entry are all mainly divided into five categories to record the transaction: (a) Asset (b) Liability (c) Capital (d) Expenses or losses (e) Revenue or gains.

In the books of accounts two fundamental rules are followed to record the changes in these accounts:

(1) For recording changes in Assets or Expenses losses:

-

- An increase in the asset is debit and a decrease in the asset is credit.

- An increase in expenses or losses is debit and a decrease in expenses or losses is credit.

(2) For recording changes in Liabilities and Capital revenue or gains

-

- An increase in liabilities is credit and a decrease in liabilities is debit.

- the capital increase is credit and a decrease in the capital is debit.

- An increase in revenue or gain is credit and a decrease in revenue or gain is credit.

Books of Accounts in Original entry

In the books of accounts, the method of analyzing transactions and recording their outcomes immediately within the money owed is useful as a going-to-know exercise.

However, real accounting structures do not document transactions immediately within the accounts. The book in which the transaction is recorded for the first time is known as a journal or book of original entries. The supplied document, as mentioned earlier, is required to document the transaction within the journal. This exercise affords a whole file of each transaction in one place and hyperlinks the debits and credit for each transaction.

After the debits and credits for each transaction are entered within the journal, they’re transferred to the individual accounts. The method of recording transactions within the journal is called journalizing. Once the journalizing procedure is completed.

The journal entry provides an entire and beneficial description of the event’s impact on the organization. The process of transferring journal entries to the person’s money owed is referred to as posting.

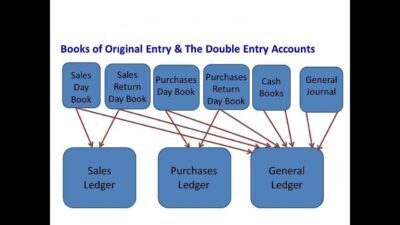

This sequence causes the journal to be referred to as the Book of Original Entry and the ledger account as the Principal Book of Entry. In this context, it needs to be noted that on account of the wide variety and commonality of most transactions, the journal is subdivided into a range of books of authentic entries as follows:

- Journal Proper

- Cashbook

- Other day books:

- Purchase Book

- Sales Book

- Purchase Return Book

- Sales Return Book

Now, We discuss the process of journaling and posting into the ledger in books of Accounts. There are under following:-

Journal

This is a simple book of original entries. In this book, transactions are recorded in chronological order, as and once they happen. Afterwards, transactions from this book are posted to the respective accounts. Each transaction is one by one recorded after deciding the precise account to be debited or credited.

JOURNAL

| Date | Particulars | L.F. | Debit Amt. ( Rs.) | Credit Amt. (Rs.) |

The first column of a journal is the Date on which the transaction happened. In the Particulars column, the account title to be debited is written on the primary line beginning from the left-hand corner, and therefore the word ‘Dr.’ is written at the end of the column.

The account title to be credited is written on the second line leaving a sufficient margin on the left side with the prefix ‘To’. Below the account titles, a quick description of the transaction is given which is named Narration. Having written the Narration a line is drawn within the Particulars column, which indicates the top of recording the precise journal entry.

The column concerning Ledger Folio records the pagination of the ledger book on which the relevant account appears. This column is filled up at the time of posting and not at the time of creating a journal entry.

The Debit amount column records the quantity against the account to be debited and similarly, the Credit Amount column records the quantity against the account to be credited. It may be noted that the amount of transactions is extremely large and these are recorded in several pages within the journal book.

Hence, at the top of every page of the journal book, the quantity columns are totalled and carried forward (c/f) to a subsequent page where such amounts are recorded as brought forward (b/f) balances.

The journal entry is the basic record of a business transaction. It may be simple or compound. When only two accounts are involved to record a transaction, it’s called an easy journal entry in Books of Accounts.

For Example, Goods Purchased on credit for Rs.30,000 from M/s Mohan Traders on December 24, 2019, involves only two accounts: (a) Purchases A/c (Goods), (b) Mohan Traders A/c creditors). This transaction is recorded in the journal as follows :

JOURNAL

| Date | Particulars | L.F. | Debit Amt. ( Rs.) | Credit Amt. (Rs.) |

| 24-12-2019 |

Purchase A/c Dr |

30000.00 | ||

| To Mohan Traders A/c (Purchase of goods–in–trade from Mohan Traders) | 30000.00 |

It will be seen that despite the transaction consequences in a magnified availability of products, the account debited is purchased, not goods. The things account is split into 5 accounts, viz. purchases account, sales account, purchases returns account, sales returns account, and stock account.

When the number of accounts to be debited or credited is bigger than one, an entry made for recording the transaction is mentioned as a compound journal entry. That capacity compound journal entry entails quite one account.

for instance, Office furnishings are bought from Real Furniture on Independence Day, 2019, for Rs. 25,000 and Rs. 5,000 is paid with the help of money immediately and stability of Rs. 20,000 is nonetheless payable. it’ll increase fixtures (assets) by Rs. 25,000, decrease money (assets) using Rs. 5,000 and increase liability by way of Rs. 20,000. The entry made within the journal on Independence Day, 2019, is :

JOURNAL

| Date | Particulars | L.F. | Debit Amt. ( Rs.) | Credit Amt. (Rs.) |

| 04-07-2019 | Office Furniture A/c Dr | 25000.00 | ||

| To Cash A/c | 5000.00 | |||

| To Real Furniture A/c | 20000.00 | |||

| ( Purchase of Office Furniture from Real Furniture) |

The Ledger

The ledger is the fundamental book of the accounting system. It consists of specific accounts where transactions touching on that account are recorded. A ledger may be a series of all the accounts, debited or credited, within the journal ideal and a spread of one-of-a-kind journals.

A ledger may additionally be within the structure of a sure register, or cards, or separate sheets can also be maintained during a free leaf binder. In the ledger, each account is opened ideally on a separate page or card.

The Utility of Ledger

A ledger is very beneficial and is of utmost significance in the organization. The net result of all transactions in admiration of a specific account on a given date can be ascertained solely from the ledger.

For example, the administration on a particular date desires to be aware of the quantity due from a positive patron or the quantity the firm has to pay to a specific supplier, such records can be observed solely in the ledger. Such facts are very tough to verify from the journal because the transactions are recorded in chronological order and defy classification. For effortless posting and location, bills are opened in the ledger in some definite order.

For example, they may additionally be opened in equal order as they show up in the profit and loss account and instability sheet. In the beginning, an index is also provided. For handy identification, in large organizations, every account is also allotted a code number.

Cash Book

Cashbook may be a book during which all transactions concerning cash receipts and cash payments are recorded. It starts with the cash or bank balances at the start of the amount. Generally, it’s made every month. this is often a really popular book and is maintained by all organizations, big or small, profit or not-for-profit.

It serves the aim of both journals also because of the ledger (cash) account. it’s also called the Book of Original Entry. When a cashbook is maintained, transactions of money aren’t recorded within the journal, and no separate account for cash or bank is required within the ledger. There are two sorts of cash books:

- Single Column:

The single-column cash book records all cash transactions of the commercial enterprise in chronological order, i.e., it’s an entire report of money receipts and cash payments. When all receipts and repayments are made in cash with the help of a business only, the cash book carries solely one amount column on each (debit and credit) side.

Purchase Return Book

| Date | Debit Note No. | Name of the Supplier ( Account to be debited) | L.F. | Amount Rs. |

Debit & Credit Notes

- Sales Return Book:

This journal is employed to record the return of products by customers to them on credit. On receipt of products from the customer, a credit note is ready, just like the debit note mentioned earlier. The difference between the credit note and therefore the debit note is that the previous is ready by the vendor and the latter is ready by the customer.

Just like the debit note, the credit note is additionally prepared in duplicate and contains details concerning the name of the customer, details of the merchandise received back, and therefore the amount. Each credit note is serially numbered and dated. The source document for recording entries within the sales return book is usually the credit note.

Sales Return Book

| Date | Credit Note No. | Name of the Customer ( Account to be debited) | L.F. | Amount Rs. |

Purchase book

| Date | Invoice No. | Name of Supplier ( Account to be credited) | L.F. | Amount Rs. |

Sales Book

All credit sales of merchandise are recorded within the sales journal. Cash sales are recorded within the cash book. The source document for recording entries within the sales journal is the sales invoice or bill issued by the firm to the purchasers.

The date of sale, invoice number, name of the customer, and amount of the invoice are recorded within the sales journal. Other details about the sales transaction including terms of payment are available within the invoice.

Two or quite two copies of a sales invoice are prepared for each sale. The bookkeeper makes entries within the sales journal from one copy of the sales invoice. The format of the sales journal is shown in Figure 4.8. within the sales journal, one additional column could even be added to record sales tax recovered from the customer and to be paid to the govt. within the stipulated time. Periodically, at the top of every month, the quantity column is completely led and posted to the credit of the sales account within the ledger. Posting to the accounting of individual customers’ accounts could also be made daily.

Sales Book

| Date | Invoice No. | Name of the Customer ( Account to be debited) | L.F. | Amount Rs. |

Purchase Return Book

Purchases’ return of products is recorded. Sometimes goods purchased are returned to the supplier for various reasons like the products aren’t of the specified quality, or are defective, etc. For each return, a debit note (in duplicate) is ready and therefore the original one is shipped to the supplier to create necessary entries in his book.

The supplier can also prepare a note, which is named the credit note. The source document for recording entries within the purchases returns journal is usually a debit note. A debit note will contain the name of the party (to whom the products are returned) details of the products returned and therefore the reason for returning the products. Each debit note is serially numbered and dated.

Purchase Return Book

| Date | Debit Note No. | Name of the Supplier ( Account to be debited) | L.F. | Amount Rs. |

Debit & Credit Notes

- Sales Return Book:

This journal is employed to record the return of products by customers to them on credit. On receipt of products from the customer, a credit note is ready, just like the debit note mentioned earlier. The difference between the credit note and therefore the debit note is that the previous is ready by the vendor and the latter is ready by the customer.

Just like the debit note, the credit note is additionally prepared in duplicate and contains details concerning the name of the customer, details of the merchandise received back, and therefore the amount. Each credit note is serially numbered and dated. The source document for recording entries within the sales return book is usually the credit note.

Sales Return Book

| Date | Credit Note No. | Name of the Customer ( Account to be debited) | L.F. | Amount Rs. |

Cash Book

Dr Cr.

| Date | Receipts | L.F. | Amount | Rs. | Date | Receipts | L.F. | Amount | Rs. |

- Double Column:

In this sort of cash book, there are two columns of amounts on all sides of the cash book. Nowadays bank transactions are very large in number. In many organizations, as far as possible, all receipts and payments are effected through the bank. A businessman generally opens an account with a bank. Bank, does not allow any interest on the balance in the current account but charges a small amount, called incidental charges, for the services rendered.

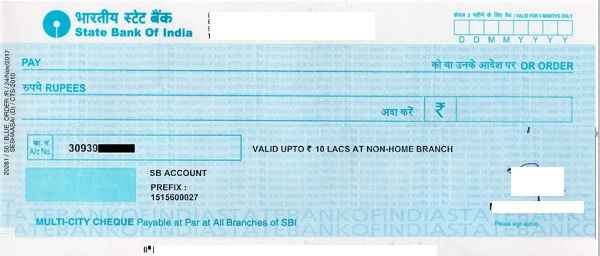

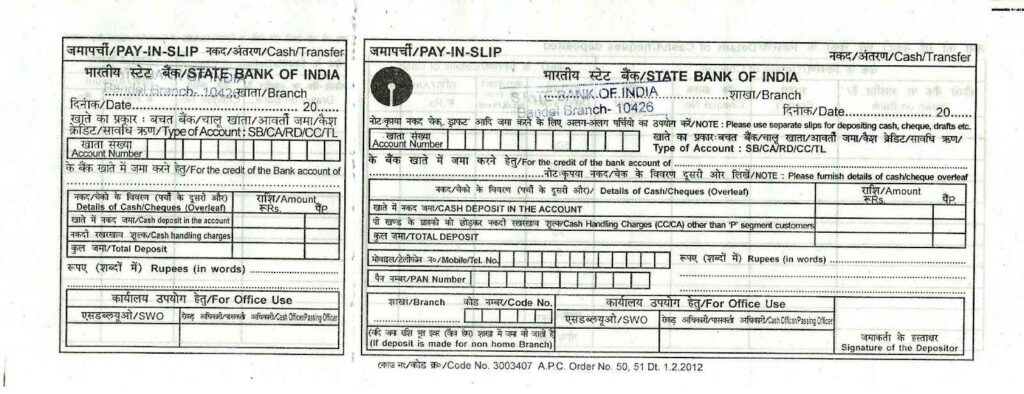

For depositing cash/cheques in the bank account, a form has to be filled, which is called a pay-in slip. It contains a counterfoil also which is returned to the customer (depositor) with the signature of the cashier, as a receipt.

The bank issues blank cheque forms, to the account holder for withdrawing money. The depositor writes the name of the party to whom payment is to be made after the words Pay printed on the cheque.

Cheque forms have the printed word bearer, which suggests payment is to be made to the person whose name has been written after the words “pay” or the bearer of the cheques. When the planet ‘bearer’ is struck off by drawing a line, the cheque becomes an order cheque. It means payment is to be made to the person whose name is written on the cheque or to his order after proper identification.

Cheques are generally crossed in practice. The payment of a crossed cheque can’t be made directly to the party on the counter. it’s to be paid only through a bank. When two parallel lines are drawn across the cheque, it’s said to be crossed.

In the case of an A/c payee-only crossing, the quantity of the cheque is often deposited only within the account of the person whose name appears on the cheque. When the name of the bank is written between two parallel lines, it becomes a special crossing and therefore the payment is often made only to the bank whose name has been written between the 2 lines.

A cheque is often transferred by the payee (the person in whose favour the cheque has been drawn) to a different person if it’s not crossed A/c payee only. A bearer cheque is often passed on by mere delivery. An order cheque is often transferred by endorsement and delivery. endorsement means the writing of instructions to pay the cheque to a specific person and then singing it on the rear of the cheque.

When the amount of bank transactions is large; it’s convenient to possess a separate amount column for bank transactions within the cash book itself rather than recording them within the journal. This helps in getting information about the position of the checking account from time to time.

Just like cash transactions, all payments into the bank are recorded on the left side and every withdrawal/payment through the bank is recorded on the proper side. When cash is deposited in the bank or cash is withdrawn from the bank, both entries are recorded in the cash book.

This is so because both aspects of the transaction appear in the cash book itself. When cash is paid into the bank, the quantity deposited is written on the left side within the bank column, and at an equivalent time, an equivalent amount is entered on the right side in the cash column.

The reverse entries are recorded when cash is withdrawn from the bank to be used within the office. Against such entries, the word C, which stands for contra is written within the L.F. column indicating that these entries aren’t to be posted to the ledger account.

The bank column is balanced in the same way because of the cash column. However, in the bank column, there can be a credit balance also because of an overdraft taken from the bank. An overdraft may be a situation when cash withdrawn from the bank exceeds the quantity of the deposit. Entries in respect of cheques received should be made within the bank column of the cash book.

When a cheque is received, it’s going to be deposited into the bank on an equivalent day or it’s going to be deposited on another day. In case, it’s deposited on an equivalent day the quantity is recorded within the bank column of the cash book on the receipts side.

If the cheque is deposited on another day, therein case, on the date of receipt it’s treated as cash received and hence recorded within the cash column on the receipts side. On the day of deposit to the bank, it is shown in the Bank Column on the receipt (Dr.) side and in the Cash Column on the payment (Cr.) side. This is a contra entry.

If a cheque received from a customer is dishonoured, the bank will return the dishonoured cheque and debit the firm’s account. On receipt of such cheque or intimation from the bank, the firm will make an entry on the accounting of the cash book by entering the quantity of the dishonoured cheque within the bank column and therefore the name of the customer within the particulars column.

This entry will restore the position prevailing before the receipt of the cheque from the customer and its deposit within the bank. Dishonour of a cheque means the return of the cheque unpaid, generally thanks to insufficient funds within the customer’s account with the bank.

If the bank debits the firm on account of interest, commission, or other charges for bank services, the entry is going to be made on the accounting within the bank column. If the bank credits the firm’s account, the entry will be made on the debit side of the cash book in the appropriate column.

Others daybook

Purchase Book

All credit purchases of products are recorded within the purchases journal whereas cash purchases are recorded within the cash book. Other purchases like purchases of office equipment, furniture, and buildings, are recorded within the journal proper if purchased on credit or within the cash book if purchased for cash.

The source documents for recording entries within the book are invoices or bills received by the firm from the supplies of the products. Entries are made with the internet amount of the invoice. Trade discounts and other details of the invoice needn’t be recorded in this book.

Purchase book

| Date | Invoice No. | Name of Supplier ( Account to be credited) | L.F. | Amount Rs. |

Sales Book

All credit sales of merchandise are recorded within the sales journal. Cash sales are recorded within the cash book. The source document for recording entries within the sales journal is the sales invoice or bill issued by the firm to the purchasers.

The date of sale, invoice number, name of the customer, and amount of the invoice are recorded within the sales journal. Other details about the sales transaction including terms of payment are available within the invoice.

Two or quite two copies of a sales invoice are prepared for each sale. The bookkeeper makes entries within the sales journal from one copy of the sales invoice. The format of the sales journal is shown in Figure 4.8. within the sales journal, one additional column could even be added to record sales tax recovered from the customer and to be paid to the govt. within the stipulated time. Periodically, at the top of every month, the quantity column is completely led and posted to the credit of the sales account within the ledger. Posting to the accounting of individual customers’ accounts could also be made daily.

Sales Book

| Date | Invoice No. | Name of the Customer ( Account to be debited) | L.F. | Amount Rs. |

Purchase Return Book

Purchases’ return of products is recorded. Sometimes goods purchased are returned to the supplier for various reasons like the products aren’t of the specified quality, or are defective, etc. For each return, a debit note (in duplicate) is ready and therefore the original one is shipped to the supplier to create necessary entries in his book.

The supplier can also prepare a note, which is named the credit note. The source document for recording entries within the purchases returns journal is usually a debit note. A debit note will contain the name of the party (to whom the products are returned) details of the products returned and therefore the reason for returning the products. Each debit note is serially numbered and dated.

Purchase Return Book

| Date | Debit Note No. | Name of the Supplier ( Account to be debited) | L.F. | Amount Rs. |

Debit & Credit Notes

- Sales Return Book:

This journal is employed to record the return of products by customers to them on credit. On receipt of products from the customer, a credit note is ready, just like the debit note mentioned earlier. The difference between the credit note and therefore the debit note is that the previous is ready by the vendor and the latter is ready by the customer.

Just like the debit note, the credit note is additionally prepared in duplicate and contains details concerning the name of the customer, details of the merchandise received back, and therefore the amount. Each credit note is serially numbered and dated. The source document for recording entries within the sales return book is usually the credit note.

Sales Return Book

| Date | Credit Note No. | Name of the Customer ( Account to be debited) | L.F. | Amount Rs. |

1 thought on “Books of Accounts”