Contents

Introduction of Imprest System in Accounting

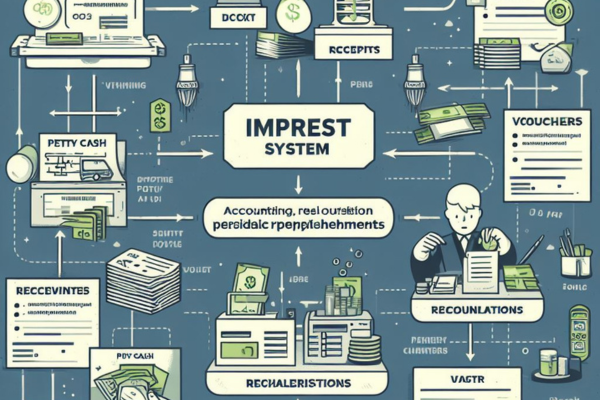

In the difficult realm of accounting, the Imprest System stands out as an integral notion that simplifies monetary management. Let’s embark on a trip to be aware of the essence of the Imprest System, exploring its importance, features, and the myriad advantages it presents to groups and individuals.

What is the Imprest System in Accounting?

The Imprest System in Accounting, additionally acknowledged as the Petty Cash System, is a technique used to control small, hobby charges efficiently. It entails retaining a constant quantity of cash, acknowledged as the imprest balance, which is replenished periodically to ensure a steady fund level. This machine is specifically beneficial for coping with sundry costs like workplace supplies, journey expenses, and miscellaneous disbursements that happen regularly but do not warrant complicated accounting processes.

Importance of the Imprest System in Accounting

1. Simplicity and Efficiency:

The Imprest System simplifies the recording of small transactions, decreasing the administrative burden related to certain bookkeeping for minors.

2. expenses.

Its easy nature streamlines the compensation process, making it faster and extra efficient.

3. Control Over Small Expenditures:

By putting a constant imprest balance, agencies acquire higher management over their petty money expenditures. This helps stop the misuse or unauthorized spending. It ensures that there may be accountability for each, and every cent spent, fostering a way of life of accountability amongst employees.

4. Flexibility and Adaptability:

The Imprest System is adaptable to several commercial enterprise sizes and industries. Whether it is a small startup or a giant corporation, the system’s flexibility makes it relevant throughout the board. It incorporates the dynamic nature of minor expenses, presenting an answer that can evolve with the altering wishes of the business.

5. Reduced Burden on Main Accounts:

By segregating small, activity fees via the Imprest System, the most important bills are spared from the litter of several minor transactions. This enhances the accuracy and readability of monetary reporting.

6. Emergency Preparedness:

The Imprest System ensures that there is continually an easily accessible money reserve for surprising or emergency expenses. This instantaneous accessibility is essential for preserving enterprise continuity.

Features of the Imprest System in Accounting

1. Fixed Imprest Balance:

At the core of the Imprest System is the thinking of a constant imprest balance. This predetermined quantity is maintained in the petty money fund, making sure a consistent pool of money for minor expenditures.

2 Replenishment Mechanism:

Periodically, the imprest stability is replenished to its authentic amount. This method entails auditing the petty money expenses, verifying receipts, and including the whole quantity spent again into the petty money fund.

3. Designated Custodian:

The machine designates a custodian accountable for managing the petty money fund. This man or woman is to blame for each the safety of the fund and the accuracy of its disbursement.

4. Expense Documentation:

Every expenditure made from the petty money fund is documented via receipts. These receipts serve as a path of evidence, making sure transparency and accountability in the spending process.

5. Segregation of Duties:

To stop fraud or misuse, the Imprest System regularly includes segregating obligations associated to petty cash. For instance, the custodian accountable for managing the fund may additionally now not be the equal individual who approves expenses.

6. Usage Limitations:

The Imprest System commonly outlines precise recommendations on what kinds of charges can be included in the use of petty cash. This helps in keeping the focal point on the supposed reason for the fund.

7. Regular Audits:

Regular audits of the petty money fund are an integral characteristic of the Imprest System. These audits make sure that the fund is being used appropriately, and that any discrepancies are directly addressed.

Benefits of Imprest System in Accounting

1. Accuracy and Transparency:

The Imprest System enhances the accuracy of economic information with the aid of offering a clear path for small transactions. This ensures that monetary reviews are dependable and can be without difficulty audited.

2. Time and Cost Savings:

By streamlining the coping with of small expenses, the Imprest System saves time and reduces administrative costs. The simplicity of the machine’s capability much less time spent on complicated bookkeeping tasks.

3. Improved Accountability:

Assigning a custodian and requiring applicable documentation for petty money costs instills a feeling of accountability. This accountability minimizes the danger of money being misused or misappropriated.

4. Efficient Emergency Response:

The instantaneous availability of constant imprest stability ensures that groups can reply hastily to unexpected costs or emergencies. This can be vital for preserving operational continuity.

5. Enhanced Budget Control:

The Imprest System helps higher management over budgetary allocations using virtually delineating and managing minor expenditures. This prevents overspending in precise classes and helps usual financial adherence.

6. Flexibility in Spending:

The flexibility of the Imprest System allows organizations to adapt to altering needs. Whether it is surprising journey expenses, workplace supplies, or any different minor cost, the device comprises a variety of expenditures.

7. Prevention of Unauthorized Spending:

With its shape of constant imprest balances and documentation requirements, the Imprest System acts as a deterrent towards unauthorized spending. This manipulation mechanism is indispensable for monetary integrity.

8. Simplified Reconciliation:

Reconciling the petty money fund is an easy method in the Imprest System. Regular replenishments contain an easy calculation of complete expenses, making the reconciliation procedure rapid and accurate.

9. Scalability:

The Imprest System is scalable, making it appropriate for corporations of various sizes. Whether it is a small startup with restricted fees or a massive agency with several departments, the gadget adapts seamlessly.

10. Employee Empowerment:

For personnel dealing with minor expenses, the Imprest System gives a mechanism for empowerment. It approves extra autonomy in managing small costs, lowering forms, and rushing up the compensation process.

Conclusion:

In the problematic tapestry of accounting, the Imprest System emerges as a beacon of simplicity and efficiency. Its significance lies now not solely in its capability to streamline small transactions but additionally in its capability to decorate control, transparency, and accountability. The elements of the Imprest System, from constant imprest balances to specific custodians, ensure a structured and dependable method of managing petty cash.

The advantages of adopting Imprest Accounting are far-reaching, impacting accuracy, time and fee savings, accountability, and emergency responsiveness. In a world the place monetary administration can be complex, the Imprest System stands as a testimony to the electricity of simplicity. It is no longer in simple terms a method; it’s a strategic device that empowers agencies and humans to manipulate their price range with clarity, precision, and confidence. Embrace the Imprest System and witness a transformation in the way you manage the nuances of economic management.

Leave a Reply