Contents

What is Petty Cash Book in Accounting?

Petty cash book in accounting – In every organization a Petty Cash Book is maintained by many small payments such as conveyance, cartage, postage, telegrams, and other expenses (collectively recorded under miscellaneous expenses) made. These are generally repetitive in nature. If all these payments are handled by the cashier and are recorded in the main cash book, the procedure is found to be very cumbersome. The cashier may be overburdened, and the cash book may become very bulky.

To avoid this, large organizations normally appoint one more cashier (petty cashier) and maintain a separate cash book to record these transactions. Such a cash book maintained by the petty cashier is called a petty cash book in accounting.

The petty cashier works on the Imprest system. Under this system, a definite sum, say Rs. 2,000 is given to the petty cashier at the start of a particular period. This amount is called the imprest amount. The petty cashier goes on making all small payments out of this imprest amount and when he has spent a substantial portion of the imprest amount say Rs.1,780, he gets reimbursement of the quantity spent from the top cashier.

Thus, he again has the complete imprest amount at the start of the subsequent period. The reimbursement could also be made on a weekly, fortnightly, or monthly basis, counting on the frequency of small payments. (In certain cases, the fund system is operated through the cash book itself. In such instances, the fund book isn’t maintained independently.)

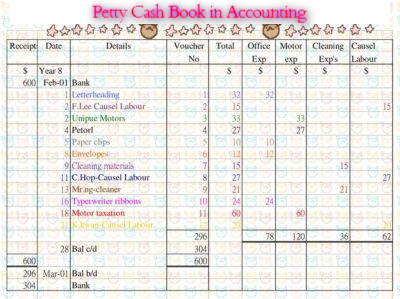

In the Petty Cash Book in Accounting payment side (credit) besides the first amount column. Each of the number columns is allotted for items of specific payments, which are commonest. The last amount column is designated as ‘Miscellaneous’ followed by a ‘Remarks’ column.

In the miscellaneous column, those payments are recorded so that a separate column doesn’t exist. In the ‘Remarks’ the character of payment is recorded. At the top of the amount, all amount columns are calculated. The total amount column l shows the entire amount spent and to be reimbursed. On the receipt (debit) side, there’s just one amount column. Columns for the date, voucher number, and particulars are common for both receipts and payments.

Advantages of Maintaining Petty Cash Book in Accounting

-

Saving of Time and efforts of the chief cashier

The chief cashier is not required to deal with petty disbursements. He can concentrate on cash transactions involving a large amount of cash. It saves time and labour and helps the chief cashier to discharge his duties more effectively.

-

Effective control over cash disbursements

Cash control becomes easy because of the division of work. The head cashier can control big payments directly and petty payments by keeping a proper check on the petty cashier. This way the chances of making frauds and embezzlements become very difficult.

-

Convenient recording

Recording petty disbursements in the main cash book makes it bulky and unmanageable. Further, the materiality principle requires that insignificant details need not be given in the main cash book. This way the cash book reveals only material and useful information.

Recording of such small payments becomes easy as the totals of different types of expenses are posted to the ledger. It also saves the time and effort of posting individual items in the ledger. In a nutshell, it can be stated that the preparation of the petty cash book is a cost-reduction control measure.

For example, Mr Mahesh, the petty cashier of M/s Abc Traders received Rupees 2,000 on May 01, 2018, from the Head Cashier. For the month, details of petty expenses are listed hereunder:

| Date May’2018 | Details | Amount Rs. |

| 02 | Auto fare | 55 |

| 03 | Courier services | 40 |

| 04 | Computer Stationery | 225 |

| 05 | Cartage | 125 |

| 06 | Bus fare | 65 |

| 08 | Taxi fare | 255 |

| 08 | Refreshments | 105 |

| 10 | Courier services | 40 |

| 12 | Unloading charges | 90 |

| 13 | Office sanitation including disinfectant | 115 |

| 14 | Photo stating charges | 55 |

| 16 | Erasers/Sharpeners/Pencils/Pads | 250 |

| 19 | Registered postal charges | 67 |

Posting from the Petty Cash Book in Accounting

The petty cash book is balanced periodically. The difference between the total receipts and total payments is the balance with the petty cashier. The balance is carried to a subsequent period and therefore the petty cashier is paid the quantity spent. A fund account is opened within the ledger. It is debited with the quantity given to the petty cashier.

Each travel and entertainment account is individually debited with the periodic total as per the respective column by writing “petty cash account” and therefore the fund account is credited with the total expenditure incurred during the amount by writing sundries as per the fund book. The petty cash account is balanced. It reflects the actual cash with the petty cashier.

Books of Abc Traders

| Amount Received | Date of May’ | Particulars | Voucher | Amount Paid | Analysis |

Of |

Payments |

|||

| Rs. | 2018 | No. | Rs. | Postage | Conveyance | Stationary | Misc | |||

| 2000 | 01 | Cash Received | ||||||||

| 02 | Auto fare | 55 | 55 | |||||||

| 03 | Courier services | 40 | 40 | |||||||

| 04 | Computer Stationery | 225 | 225 | |||||||

| 05 | Cartage | 125 | 125 | |||||||

| 06 | Bus fare | 65 | 65 | |||||||

| 08 | Taxi fare | 255 | 255 | |||||||

| 08 | Refreshments | 105 | 105 | |||||||

| 10 | Courier services | 40 | 40 | |||||||

| 12 | Unloading charges | 90 | 90 | |||||||

| 13 | Office sanitation including disinfectant | 115 | 115 | |||||||

| 14 | Photo stating charges | 55 | 55 | |||||||

| 16 | Erasers/Sharpeners/Pencils/Pads | 250 | 250 | |||||||

| 19 | Registered postal charges | 67 | 67 | |||||||

| 1487 | 147 | 375 | 475 | 490 | ||||||

| 20 | Balance C/d | 513 | ||||||||

| 2000 | 2000 | |||||||||

| 513 1487 |

June 01 | Balance B/d Cash Received | ||||||||

Books of Abc Traders

Journal

| Date | Particulars | L.F. | Debit Amount Rs. | Credit Amount Rs. |

| 2018 | Petty Cash A/c Dr. | 2000 | ||

| May’01 | To Cash A/c | 2000 | ||

| ( Being Cash Paid to Petty Cashier) | ||||

| May’31 | Postage A/c Dr. | 147 | ||

| Conveyance A/c Dr. | 375 | |||

| Stationary A/c Dr. | 475 | |||

| Misc. A/c Dr. | 490 | |||

| To Petty Cash A/c | 1487 | |||

| ( Being Petty Expenses posted to Petty Cash Account) | ||||

| Petty Cash A/c Dr. | 1487 | |||

| To Cash A/c | 1487 |

Let me introduce you to a new way of Forex trading. X Trend Premium draws from my team’s deep well of knowledge to do almost all the hard work for you. It simply tells you the best moments to strike and you hit that trade button. It’s as easy as that!

Leave a Reply